The Best Strategy To Use For Best Broker For Forex Trading

The Best Strategy To Use For Best Broker For Forex Trading

Blog Article

What Does Best Broker For Forex Trading Mean?

Table of ContentsThe Ultimate Guide To Best Broker For Forex TradingMore About Best Broker For Forex TradingThe 5-Second Trick For Best Broker For Forex TradingThe Definitive Guide for Best Broker For Forex TradingThings about Best Broker For Forex Trading

One money set an individual may want to profession is the EUR/USD. If this particular set is trading for 1.15 pips, and they believe the exchange rate will enhance in worth, they could purchase 100,000 euros well worth of this money pair - Best Broker For Forex Trading.Normally, forex markets are closed on weekends, but it's possible some investors still trade during off-hours. With the OTC market, purchases can take area whenever two parties want to trade. In enhancement to using deep liquidity and usually 24-hour-a-day gain access to, numerous foreign exchange brokers supply easy access to utilize. With utilize, you basically borrow cash to invest by putting down a smaller amount, called margin.

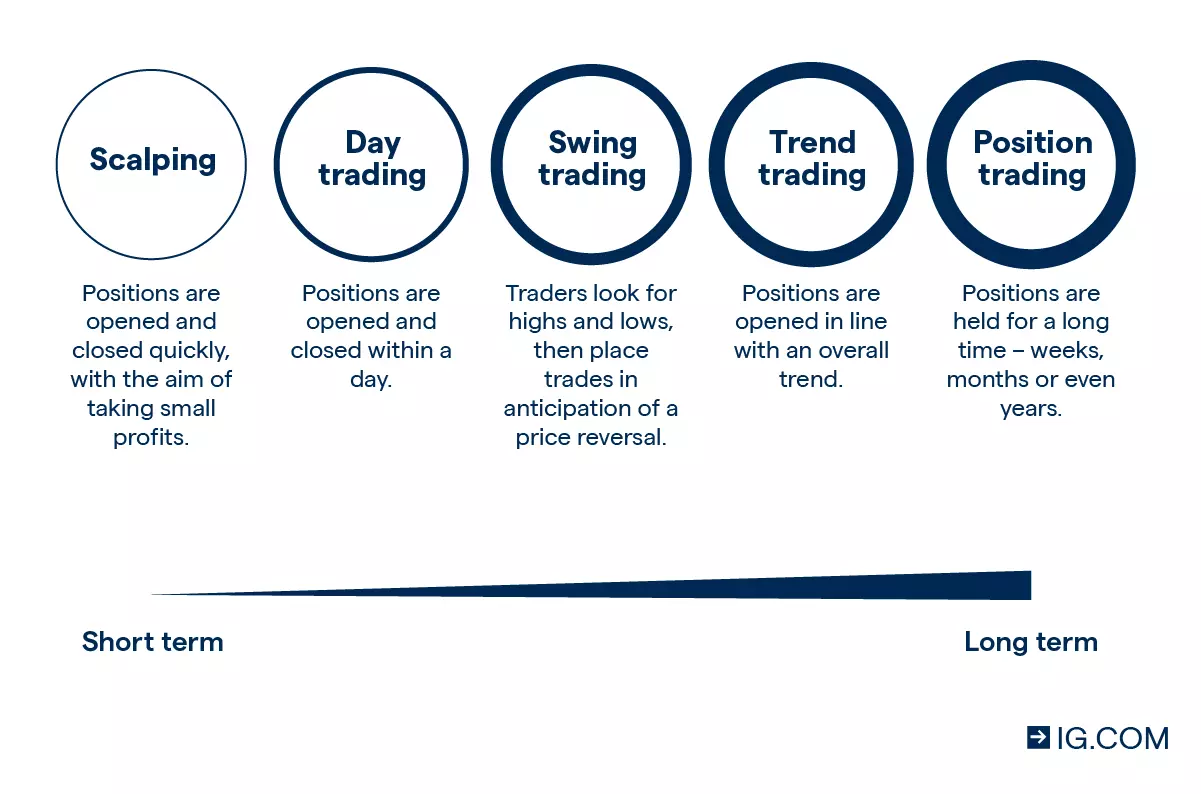

In discovering foreign exchange trading strategies for newbies, many retail financiers obtain drawn in by the very easy accessibility to leverage without understanding all the subtleties of the marketplace, and utilize can amplify their losses. For those that choose to involve in forex trading, there are various methods to select from.

Broadly, foreign exchange trading strategies, like various other kinds of investing, usually fall under either camps: technological analysis or basic analysis (Best Broker For Forex Trading). Along with basic analysis vs. technological evaluation, forex trading can additionally be based on time-related professions. These may still be based upon fundamental or technical evaluation, or they may be much more speculative wagers in the hopes of making a fast earnings, without much analysis

Best Broker For Forex Trading Can Be Fun For Everyone

Some time-based trading approaches consist of: Day trading includes acquiring and marketing the very same setting within the very same day. As an example, if you day trade the EUR/USD set, you may initially buy the setting at a rate of 1.10 and offer it later on that day for 1.101 for a slight gain.

As an example, a trader might notice that there's been recent energy in the euro's toughness vs. the U.S. dollar, so they might acquire the EU/USD set, in the hopes that in a week or so they can market for a gain, prior to the energy fizzles. Setting trading generally suggests long-term investing, rather than temporary supposition like with day trading, scalping, or swing trading.

Not known Details About Best Broker For Forex Trading

dollars, creating the price of USD to acquire vs. JPY. Even if there's no obvious underlying economic reason that the united state economic situation must be checked out extra favorably than the Japanese economic situation, a technological evaluation could identify that when the USD gains, state, 2% in one week, it often tends to enhance one more 2% the complying with week based on energy, with investors piling onto the profession for anxiety of missing out on out.

As opposed to technological evaluation that bases predictions on previous cost movements, essential evaluation looks at the underlying economic/financial reasons why a property's price might change. If that occurs, then the USD may gain toughness against the euro, so a foreign exchange capitalist making use of fundamental evaluation could try to get on the appropriate side of that trade. If United state interest rates are anticipated to drop faster than the EU's, that could trigger investors basics to prefer buying bonds in the EU, consequently driving up need for the euro and compromising need for the dollar.

Again, these are just hypotheticals, but the point is that basic evaluation bases trading on underlying factors that drive prices, besides trading activity. Best Broker For Forex Trading. In addition to finding out the ideal foreign exchange trading technique, it is essential to choose a strong foreign exchange broker. That's since brokers can see this here have different rates, such as the spread they bill between buy and sell orders, which can reduce right into prospective gains

While forex trading is usually less strictly controlled than stock trading, you still intend to select a broker that abides by appropriate policies. In the United state, you may look for a broker that's managed by the Commodity Futures Trading Payment (CFTC) and the National Futures Association (NFA). You additionally intend to assess a broker's safety and security techniques to guarantee that your cash is safe, such as examining whether the broker sets apart client funds from their very own and holds them at managed banks.

Some Ideas on Best Broker For Forex Trading You Need To Know

This can be subjective, so you may wish to seek a broker that offers trial accounts where you can obtain a feel of what trading on that system resembles. Various brokers might have different account types, such as with some geared more towards novice retail capitalists, and others toward more specialist traders.

Some have no minimum deposit, while others start at around $100. The amount you determine to start with depends on your general financial circumstance, including your overall capital and risk resistance. Yes, foreign exchange trading can be high-risk, specifically for individual capitalists. Banks and other institutional investors usually have an informative benefit over retail investors, which can make it harder for people to make money from forex trades.

Report this page